Tax Code Section 11.35 allows a qualified property that is at least 15 percent damaged by a disaster in a governor-declared disaster area to receive a temporary exemption of a portion of the appraised value of the property. A property owner must apply for the temporary exemption no later than 105 days after the governor declares a disaster area. Qualified property includes:

- tangible personal property used for income production;

- improvements to real property; and

- certain manufactured homes.

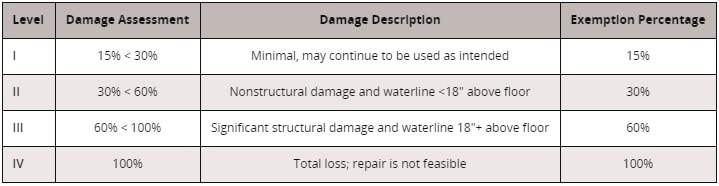

The chief appraiser determines if the property qualifies for the temporary exemption and assigns a damage assessment rating of Level I, II, III or IV. The chief appraiser may rely on information from a county emergency management authority, the Federal Emergency Management Agency (FEMA) or other appropriate sources when making this determination.

The damage assessment rating determines the percentage of appraised value of the qualified property to be exempted. The amount of the exemption is determined by multiplying the property value after applying the damage assessment rating to a fraction (365 divided by the number of days remaining in the tax year after the date the governor declares the disaster).

The chief appraiser must send written notice of the approval, modification or denial of the application to the applicant no later than five days after making the determination. The temporary disaster area exemption expires on Jan. 1 of the first tax year in which the property is reappraised.

To apply for the temporary exemption for property damaged by a disaster owners should complete the application form and return it to the Brazoria Central Appraisal District. Forms can be returned by mail (500 N. Chenango Angleton, TX 77515), email to: help@brazoriacad.org, dropped off at our office, or submitted through our online application liked below:

The deadline to apply for a temporary exemption for property damaged by a disaster related to Hurricane Beryl has passed.